Why are Compliance Audits Important for SMB’s?

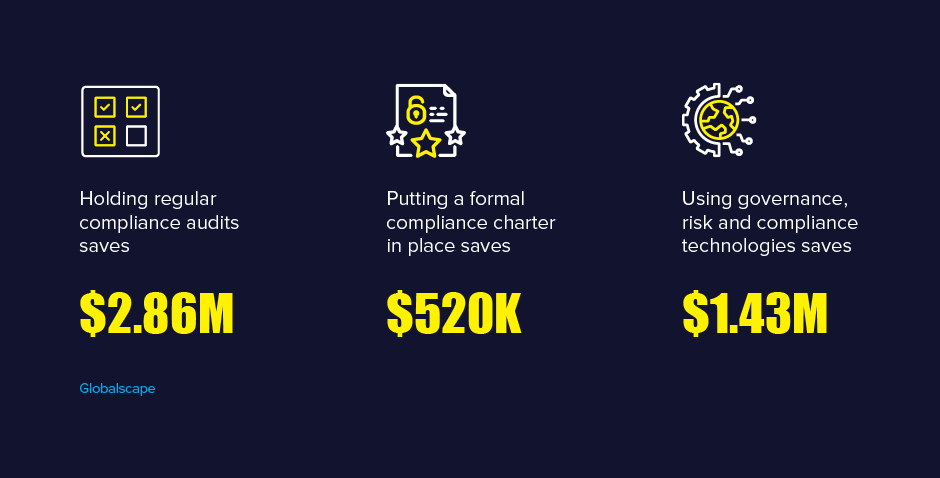

Do you know? There are 400+ million small-medium businesses out there in the world, but only 29-30% of companies conduct compliance audits every year. It’s really shocking. These entrepreneurs have no idea how much revenue and profits they are letting go by skipping compliance audit activity.

Yes, it’s true because a company can save $2.86 million annually, whereas a formal compliance charter holds only $520 thousand in the account. These are the real-time figures gathered from a recent study of Globalscape report.

The non-compliance audit costs around $14.9 million, whereas one compliance audit charges you around $12.5 m. Additionally, conducting it twice or multiple times can create a lot of difference and bring more savings. You can see the difference in the below image too.

So, have you thought it over? If not and confused on this note, read this blog and understand the importance of compliance audits for businesses today. Start reading and get your answers.

What is a Compliance Audit?

A compliance audit is a comprehensive and independent review of the organization’s adherence to the regulatory standards applicable to your business. These audits cover all aspects from cybersecurity, quality management, and workplace safety to environmental compliance. It’s up to the applicable standard or regulation that you can audit in the cases like HIPAA, SOX, GDPR, ISO, etc.

For instance: ISO 9001 certification is the gold standard of management systems. These standards are based on international guidelines that require companies to maintain strict compliance for their certificate or accreditation, but these requirements don’t stop there. Companies who want an official seal must also undergo periodic audits and show consistent improvement over time, which can be difficult with a high demand rate from other businesses vying for attention.

Now, let’s peek at the importance and benefits of compliance audits for SMBs. Take a look below.

1. Compliance Audit Identify Business Gaps

An audit is a systematic review of an organisation’s compliance with the applicable regulations. Auditors check whether business processes, systems, and practices effectively meet regulatory requirements for information security management. It includes identifying any non-compliances and reporting them to appropriate parties such as managers or government agencies if necessary.

2. Compliance Audit Aids in Improvement

If the audit reveals gaps in the organisation, you can work on it and implement corrective and preventative actions. For example, suppose employees show vulnerability to social engineering attacks during penetration testing conducted as part of cybersecurity audits. In that case, they may need additional employee training on how best to protect themselves from such schemes to keep data safe.

3. Compliance Audit Reduces Threat & Enforce Adherence With Other Frameworks

Cybersecurity threats have become more common than ever before. But compliance with cybersecurity regulations and frameworks will reduce risks. For instance, those who comply with cybersecurity regulations such as PCI DSS can avoid costly attacks from cybercriminals while complying with other frameworks like the EU’s General Data Protection Regulation (GDPR). Likewise, organisations in California are already compliant under CCPA, making them well on their way towards becoming fully compliant if states continue this trend across America.

4. Compliance Audit Avoid Penalties or Legal Trouble

Compliance with legally-binding rules is essential for a company’s success. With the help of compliance officers, businesses can avoid penalties or legal trouble when it comes to noncompliance with mandatory laws- which could quickly lead them into serious problems if they are not careful enough about following these regulations without fail.

Final Words

Compliance audits are crucial for small businesses to ensure that they’re in line with the law. They also provide peace of mind, as you can feel confident that your business is operating legally and ethically.

It gets you a clear picture of where your company stands regarding compliance, which can allow you to take action or prevent issues before they become too big of a problem.

At WeSecureApp, we know how important it is to stay updated on every last detail while running a business. That’s why we offer compliance audit services explicitly tailored for SMBs like yours. Our team will make sure all aspects of your company’s operations comply with federal regulations so you can focus on what really matters – growing your business.

So, if there is something that could benefit your small business, we encourage you to contact us today – Talk to Our Delivery Head